Loan Center Canada is a well-established company that helps Canadians by offering them the best financial services in Sudbury, Ontario. Whether you’re looking for Mortgage Loans, Home Equity Loans, Home Mortgage Loan, Second Mortgage Loan or Mortgages Refinancing. Loan Center Canada is the name you can trust without a doubt. Our team is full of talented, enthusiastic and knowledgeable members of the lending industry. What differentiates us is nothing but our quality of service and the attention we pay to our customers and our free 24/7 service. By using our services, you can have the opportunity to choose from our most reliable and secure lenders to meet your needs while keeping an eye on your monthly budget.

We use technology and the Internet to save you time and money. All you have to do is fill out our online application form, and our team of experts will locate the perfect lender to meet your specific needs and get you the lowest rate possible. This service is entirely free, and you are not required to accept quotes or services provided by participating lenders and agents.

Benefits Of Getting Loan Through Loan Center Canada

Your home is your most valuable asset. House is probably the most significant investment you will make in your life. Your home is more than a place to rest your head and raise a family. Your house contains equity. It is a valuable resource and in some cases can even be used as an ATM. So while applying for a Mortgage Loans, Home Equity Loans, Home Mortgage Loan, Second Mortgage Loan or Mortgages Refinancing, it is an excellent choice to consult an expert like Loan Center Canada. Whether you want to refinance an existing home or buy a new one, it’s essential to make informed home financing decisions. Take the time to plan and review your mortgage options with Loan Center Canada and get ready to manage your mortgage.

At Loan Center Canada, we want to change the way you think about mortgages. Maybe you think you would never qualify for a mortgage loan. Perhaps you feel a home equity loan or a second mortgage is out of the question for you. Think again. Mortgages have different attributes to meet different requirements. Moreover, we make sure you get what you are expecting when you shop for a mortgage loan.

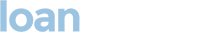

Eligibility Criteria

To get a mortgage loan, you need to fulfill certain minimum eligibility conditions. The following factors are taken into account while determining your eligibility for a mortgage loan:

- Minimum age needs to be 21 years.

- Details of existing liabilities.

- Valuation of your property.

- Financial documents.

Documnets Required

We will always go legal for the good of both parties. To complete your documentation, we need

- Your valid ID proof.

- Some passport-size photos.

- Proof of residency, indicating that you own the house in case of mortgage refinancing.

Subsequently, we ask you to complete a quick online application to complete all the information needed to draft your documents.

Loan Center Canada

Canada’s Leading Online Financial Hub

We have teamed up with a vast network of partners committed to providing Canadians various types of loans regardless of credit type.

Borrow the money you need instantly without any credit check!

Call us today to get your personalized solution for all of your credit and financial needs.

Choose a Service